WHAT YOU SHOULD KNOW ABOUT

Home Equity Lines of Credit (HELOC)

Borrowing from the value of your home

How to use the booklet

When you and your lender discuss home equity lines of credit, often referred to as HELOCs, you receive a copy of this booklet. It Helps you explore and understand you options when borrowing against the equity in your home.

You can find more information from the Consumer Financial Protection Bureau (CFPB) about home loans at cfpb.gov/mortgages. You’ll also find other mortgages-related CFPB resources, facts, and tools to help you take control of your borrowing options.

About the CFPB

The CFPB is a 21st century agency that implements and enforces federal consumer financial law and ensures that markets for consumer financial products are fair transparent, and competitive.

The pamphlet, titled What you should know about home equity lines of credit, was created to comply with federal law pursuant to 15 U.S.C 1637a(e) and 12 CFR 1026.40(e).

How can this booklet help you?

This booklet can help you decide whether home equity line of credit is the right choice for you, and help you shop for the best available option.

A home equity line of credit (HELOC) is a loan that allows you to borrow, spend, and repay as you go, using your home as collateral.

Typically, you can borrow up to a specified percentage of your equity. Equity is the value of your home minus the amount you owe on your mortgage.

Consider a HELOC if you are confident you can keep up with the loan payments. If you fall behind or can’t repay the loan on schedule you could lose your home.

After you finish this booklet:

- You’ll understand the effect of borrowing agains your home

- You’ll think through your borrowing and financing options, besides a HELOC

- You’ll see how to shop for your best HELOC offer

- You’ll see what to do if the economy or your situation changes

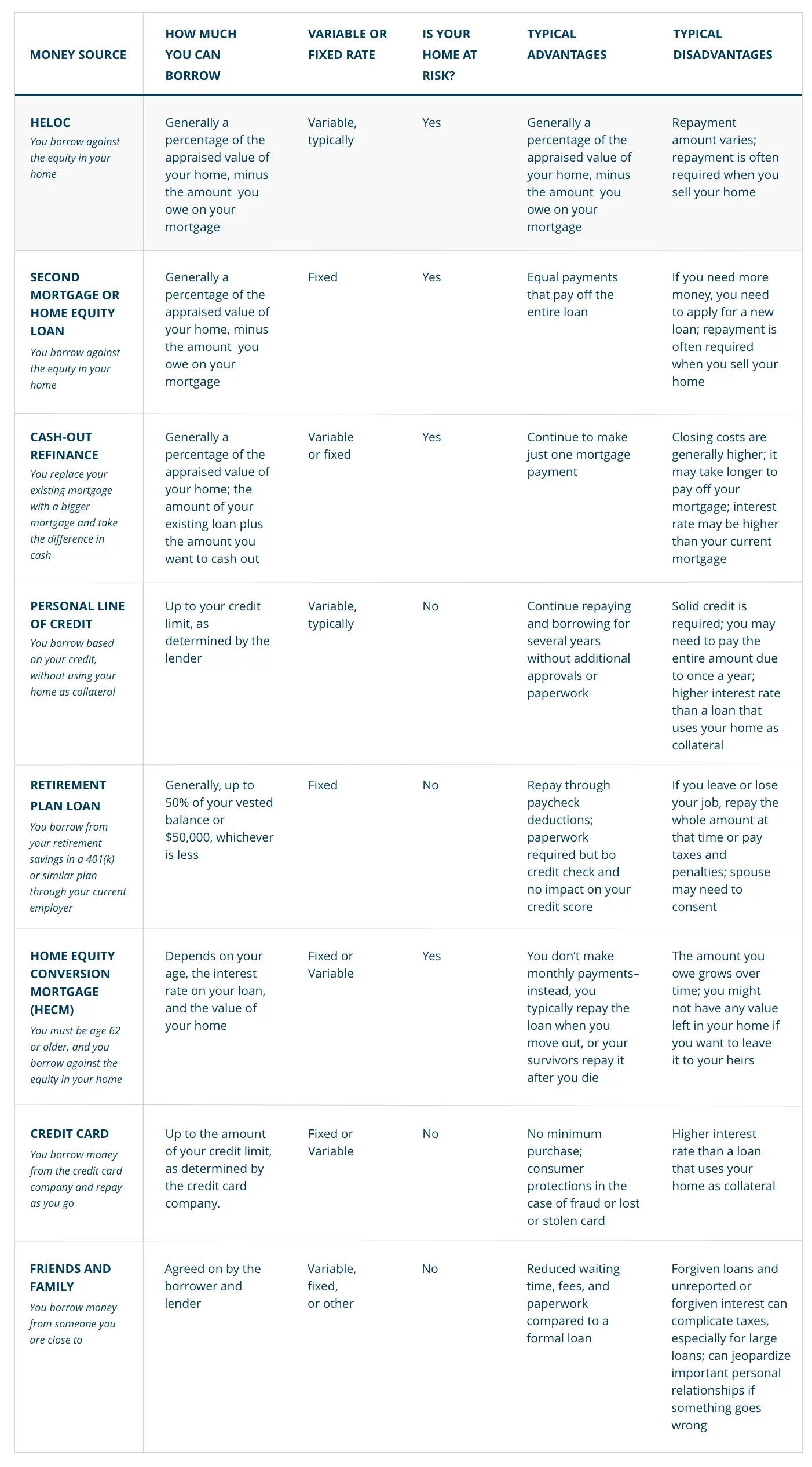

Compare a HELOC to other money Sources

Before you decide to take out a HELOC, it might make sense to consider other options that might be available to you, like the ones below.

How HELOCs work

Prepare for up-front costs

Some Lenders waive some or all of the upfront costs for a HELOC. Others may charge fees. For example you might get charged:

- A fee for a property appraisal, which is a formal estimate of the value of your home

- An application fee, which might not be refunded if you are turned down

- Closing costs, including fees for attorneys, title search, mortgage preparation and filing, property and title insurance, and taxes

Pull money from your line of credit

Once Approved for a HELOC, you can generally spend up to your credit limit whenever you want. When your line of credit is open for spending, you are in the borrowing period, also called the draw period. Typically, you use special checks or a credit card to draw on your line. Some plans require you to borrow a minimum amount each time (for example, $300) or keep a minimum amount outstanding. Some plans require you to take an initial amount when the credit line is set up.

Make Repayments during the “Draw Period:

Some plans set a minimum monthly payment that includes a portion of principal (The amount you borrow) plus accrued interest. The portion of your payment that goes toward principal typically does not repay the principal by the end of the term. Other plans may allow payment of the interest only, during the draw period, which means that you pay nothing toward the principal.

If your plan has a variable interest rate, your monthly payments may change even if you don’t draw more money.

Enter the “Repayment Period”

Whatever your payment arrangements during the draw period–whether you pay some, a little, or none of the principal amount of the loan–when the draw period ends you enter a repayment period. Your lender may set a schedule so that you repay the full amount, often over ten or 15 years.

Or, you may have to pay the entire balanced owed, all at once, which might be a large amount called a balloon payment. You must be prepared to make this balloon payment by refinancing it with the lender, or getting a loan from another lender, or some other means. If you are unable to pay the balloon payment in full, you could lose your home.

Renew or close out the line of credit

At the end of the repayment period, your lender might encourage you to leave the line of credit open. This way you don’t have to go through the cost and expense of a new loan, if you expect to borrow again. Be sure you understand if annual maintenance fees or other fees apply, even if you are not actively using the credit line.

How variable interest rates work

Home equity lines of credit typically involve variable rather than fixed rates.

A variable interest rate generally has two parts: the index and the margin.

An index is a measure of interest rates generally that reflects trends in the overall economy. Different lenders use different indexes in their loans. Common indexes include the U.S. prime rate and the Constant Maturity Treasury (CMT) rate. Talk with your lender to find out more about the index they use.

The margin is an extra percentage that the lender adds to the index.

Lenders sometimes offer a temporarily discounted interest rate fr home equity lines–an introductory or teaser rate that is unusually low for a short period, such as six months.

Rights and responsibilities

Lenders are required to disclose the terms and costs of their home equity lines of credit. They need to tell you:

- Annual percentage rate (APR)

- Information about variable rates

- Payment terms

- Requirements on transactions, such as minimum draw amounts and number of draws allowed per year.

- Annual fees

- Miscellaneous charges

You usually get these disclosures when you receive a loan application, and you get additional disclosures before the line of credit is opened. In general, the lender cannot charge a nonrefundable fee as part of your application until three days after you have received the disclosures.

If the lender changes the terms before the loan is made, you can decide not to go forward with it, and the lender must return all fees. There is one exception: the variable interest rate might change, and in that case if you decide not to go ahead with the loan, you fees are not refunded.

Lenders must give you a list of HUD-approved housing counselors in our area. You can talk to counselor about how HELOCs work and get free or low-cost help with budgeting and money management.

Right to cancel (Also called right to rescind)

If you change your mind for any reason, under federal law, you can cancel the credit line in the first three days. Notify the lender in writing within the first three days after the account was opened. The lender must then cancel the loan and return the fees you paid, including application and appraisal fees.

If something changes during the course of the loan

HELOCs generally permit the lender to freeze or reduce your credit line if the value of your home falls or if they see a change for the worse in your financial situation. If this happens, you can:

- Talk with your lender. Find out the reason for the freeze or reduction. You might need to check your credit reports for errors that might have caused a downgrade in your credit. Or, you might need to talk with your lender about a new appraisal on your home and make sure the lender agrees to accept a new appraisal as valid.

- Shop for another line of credit. If another lender offers you a line of credit, you may be able to use that to pay off your original line of credit. Application fees and other fees may apply for the new loan.

WELL DONE!

For most people, a home is their most valuable asset. A HELOC can help you make the mot of this asset, when you understand the ins and outs and know what to expect.